Ever since I was a child, I've delighted in visual beauty. At age 12, I cut out a picture of a pink, flowery, beautifully decorated room in a magazine, hoping one day to have a room like the picture.

Ever since I was a child, I've delighted in visual beauty. At age 12, I cut out a picture of a pink, flowery, beautifully decorated room in a magazine, hoping one day to have a room like the picture.

I never got that room, but my file of beautiful decorating inspiration has grown to include virtual Pinterest boards and actual paper decorating inspiration files. And since then, I have taken my love of the visual arts to the next level.

After reaching a financial benchmark, I told my spouse that I'd like to improve our home décor with "original art." Thus began our foray into art collecting.

At Artnet.com or Saatchionline, one can buy art as easily as a mutual fund. There are search parameters, and there is the opportunity to start a collection of original art for less than $1,000. But if you want art that appreciates in value, learn the market.

According to Jeff Rabin of Artvest Partners LLC, an advisory firm for art investors, art is the most "opaque, illiquid and unregulated asset."

The lack of a designated market for art, the unique quality and diversity of art, and the personal preferences of art buyers make valuing art quite difficult. Art has none of the advantages of highly regulated international stock exchanges. Nor does the art market employ standardized evaluation metrics like those used for stocks and bonds, which are backed up with financial information and data.

But you can make money off of it, and it can be really rewarding in other ways as well. Here is a peek into our family's adventure collecting art -- and some of the different approaches we took.

1. Banking On A Big Name

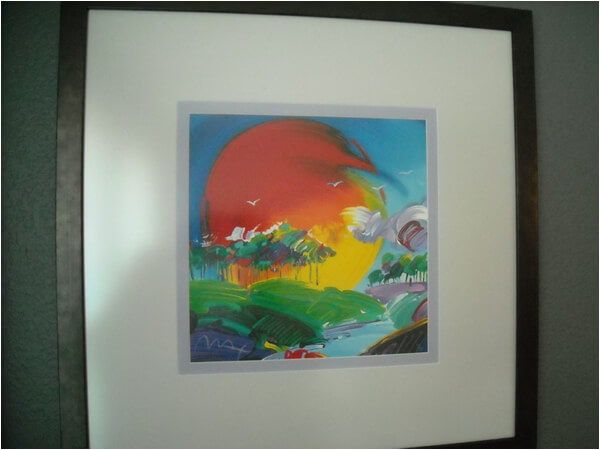

Our first purchase was a signed lithograph by renowned artist Peter Max.

Has it appreciated in value, held its own or declined in value since purchase? A quick search online for comparables led me to the conclusion that it has appreciation potential and that I would need to get an accurate valuation from an art dealer.

Although I can't determine its true value with a five-minute Google search, I am certain it is giving unquantifiable viewing pleasure as it hangs in our home. (Note that we have never had our art professionally appraised.)

2. Looks Like A Big Name Made It, But...

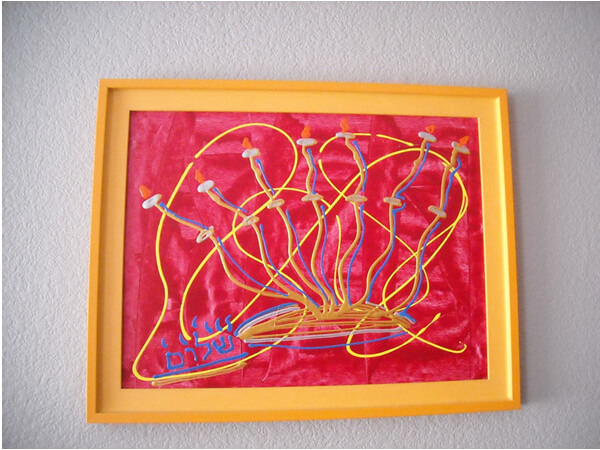

While in New York City, we added to our art collection with a piece from Steven Kaufman.

Never heard of him? He was an assistant to the legendary pop artist Andy Warhol.

.jpg)

It's easy to see Kaufman's work is similar to that of Andy Warhol. I considered it a more affordable way to purchase work from the artist who worked for years under Warhol's tutelage.

A quick eBay search showed that this artist is in demand, with original artwork selling in the thousands. We paid less than $1,000, so it looks like there is some appreciation potential. The art looks impressive in our home, so for now, we are enjoying it.

3. Embracing The Unknown

On the street, near the Museum of Modern Art in New York City, aspiring artists display their work. For under $50, we've picked up various pieces.

These hand-painted oil and acrylic displays are not likely to fetch a large sum, yet their impact when framed and hung pays emotional dividends.

This piece was picked up on the street in Madrid in front of the Prado, one of the most renowned museums in the world. This is another example of work by an unknown artist. This acrylic on canvas was priced for less than one might pay for a print at the mall.

The Investing Answer: Unlike financial assets, the only dividends an investor receives while holding original art is the pleasure of viewing the art in one's home. If you are considering starting an original art collection for pleasure, the future appreciation is less of an issue. If you are interested in collecting art for appreciation, consult with major dealers and proceed with caution. Finally, make sure you like what you are buying, since future appreciation is a gamble.

P.S. -- We may not be able to tell you how much your art will appreciate, but other investing predictions we've made have returned up to 310% gains in a year. To hear our latest, including how Apple's next breakthrough could kill the traditional bank, click here.

Barbara Friedberg is a portfolio manager, former university finance instructor and publishes BarbaraFriedbergPersonalFinance.com.